Chinese Regulators crackdown on Chinese companies 2021

The Chinese government kicked off a sweeping crackdown on its most powerful corporations a year ago, chilling investors and tech industry players alike by signaling that the leeway enjoyed by tech moguls like Jack Ma is coming to an end.

The campaign that started with Ma’s twin giants—Ant Group Co. and Alibaba Group Holding Ltd.—last November soon spread to more companies like Tencent Holdings Ltd.

and Didi Global Inc., as Beijing stepped up oversight on everything from antitrust to data security and wealth redistribution (common prosperity). The crackdown

triggered a selloff that, at its most extreme, erased over US$1.5 trillion from all listed Chinese stocks, which experienced wild swings with every new government probe, rule and warning.

Now at its one-year mark, there are signs that the clampdown may be slowing. But in its wake, the good old days of unfettered growth have given way to a new era where China’s private-sector giants are realigning themselves closer to the Communist Party.

US vs China impact on Chinese global tech companies (losing out on cloud computing and AI in US).

Chinese and American companies are locked in a hard-fought battle for technological primacy.

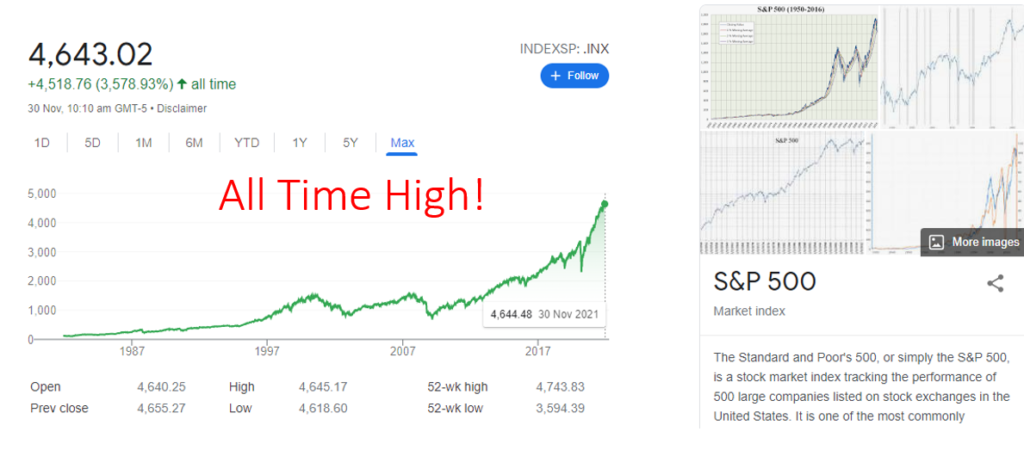

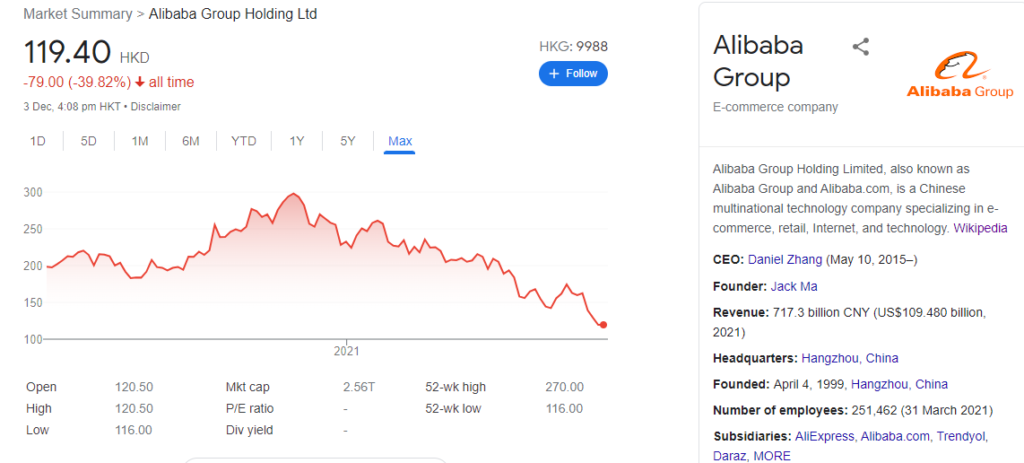

It has been a tough year for Chinese Tech companies in 2021, in particular “Alibaba”, it is down over 39% Year to Date (YTD) and a whopping 56.3% from all-time highs set back in 2020. Alibaba has lost over US$344 billion in market cap in 2021 (according to Bloomberg article). See data below:

If we compare AliCloud with other global competitiors such as Amazon’s AWS, Microsft’s Enterprise and Google cloud etc. Alibaba is currently ranked 5th in terms of market share in Cloud Computing in the world.

However, in China alone. AliCloud currently has the largest market share in China approx. over 40% of market share. With Huawei ranked 2nd (20%) and Tencent 3rd (14%)

- Alibaba said that total gross merchandise volume (GMV) reached 540.3 billion yuan (US$84.5 billion) through the first 11 days of November, culminating in the holiday on Thursday. That’s an increase of 8.5% from a year ago

- “Alibaba (BABA) launched the first Singles Day Shopping Festival on November 11, 2009. The event, which is also known as Double 11, is pegged to China’s informal, anti-Valentine’s Day holiday that celebrates people who aren’t in relationships. The date — 11.11 — was chosen because it is written as four ones, or singles.”

- Rated 5th largest AI company in the world 2020

- AliCloud history

- Based on the Business Model of Amazon’s Cloud – Amazon Web Service (AWS) Cloud

- During 2020 Tokyo Olympics, the streaming was done primarily by AliCloud

- Currently contributes over 8% of Alibaba’s total sales revenue and we project this to increase even further.

Is Alibaba a Dark Horse Company or Not?

Alibaba Group Holding Ltd. (BABA) is a holding company legally domiciled in the Cayman Islands but which conducts its e-commerce businesses through its Chinese subsidiaries and variable interest entities (VIEs). Its primary business is to offer a digital marketplace where consumers and merchants can connect and buy and sell from each other. Alibaba operates its business through four primary segments, led by its giant e-commerce operations.

Chief among its competitors are other established Chinese e-commerce and Internet companies, such as Tencent Holdings Ltd., as well as global and regional e-commerce companies, such as Amazon.com Inc. (AMZN). Since Alibaba also operates in the cloud-computing business and digital-media and digital-entertainment businesses, it competes with companies specializing in those markets as well.

However, Alibaba stock heads for lowest close since October 2019 amid pressure on China’s tech sector. Shares of Alibaba BABA, -2.25% were down 4.7% in Tuesday trading and on track for their lowest close since Oct. 24, 2019.

If the losses hold through the close, it would mark the first time that Alibaba shares closed below their pandemic low of $176.34 from March 23, 2020, according to Dow Jones Market Data.

Alibaba Cloud provides enterprise customers with a complete suite of cloud services, including database, storage, management and application services, big data analytics, a machine-learning platform, and other services.The company’s cloud computing segment generates revenue from enterprise customers based on the duration and specific usage of the services.

Cloud computing is Alibaba’s second-largest source of revenue at $2.5 billion, or about 8% of total revenue, as of Q1 FY 2022. Revenue for the segment grew 29.1% compared to the year-ago quarter.

Alibaba reported adjusted EBITA of $53 million for its cloud computing segment in Q1 FY 2022, compared to a loss in adjusted EBITA in the year-ago quarter. The cloud computing segment makes up less than 1% of overall adjusted EBITA.

More reasons:

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

- Alibaba buy back US$15b announced Q1/2? – “Alibaba Group said on Tuesday it has upsized its share repurchase program to US$15 billion from US$10 billion through 2022, the largest in the tech giant’s history demonstrating confidence in its long-term sustainable development and value creation.”

- Then a 97 years old legendary investor Charlies Munger (well known for Warren Buffett’s long time business partner) double down on investment to Alibaba. Munger boosted its long position in Alibaba by over 80% during Q3 of 2021, to over 302,000 shares

- Another one, Tom Hayes, chairman and managing member of Great Hill Capital quotes “For starters, successful people do what unsuccessful people won’t. He’s willing to take some short-term pain for long-term gain. Not on the basis of wishing or hoping, but on the basis of facts and data,”

- On the recent Q3 announcements, revenue increased over 29% year on year plus active users increased to over 1.2billions users?

- Lastly, this 2021 Singles Day break new record high!

History

- In a recent CNBC interview by Joseph Tsai (co-founder of Alibaba along with Jack Ma) talks about how he first Jack Ma and how it all began…bunch of nerds using handwritten notes to record users and a very confident Chinese guy who was a former English Teacher and translators from Han Zhou…

- One of the 1st question Joe Tsai asked Jack was, where is Alibaba incorporated. He replies, “what does that even mean…” Joe reiterate by asking, where is the company registered. Jack replies, “this is the company, what you see now”.

- With the support of SoftBank Group (majority shareholder), Alibaba became the largest IPO in the world on September 2014, raised approximately US$25 billion…In fact the top 3 largest IPOs ever in the world are all Chinese companies. They are 1) Alibaba 2) Agriculture Bank of China and 3) Industrial and Commercial Bank of China.

Is Alipay better than PayPal?

A key difference is Paypal also charges for foreign (cross border) FX exchange fees whereas Alipay only charges a transaction fee. Another key difference is Paypal assists the wire of funds between users’-bank accounts, but Alipay qualifies and then moves funds between buyer-and-merchant-Alipay accounts.

Ant’s IPO puts the company’s valuation at dizzying heights. At about $315 billion, Ant is worth more than the gross domestic products of Egypt, Chile or Finland. For corporate comparisons, it’s bigger than JPMorgan Chase & Co., the biggest U.S. bank. Ant is larger than payment rival Paypal Holdings Inc., media giant Walt Disney Co. and dwarfs Bank of America Corp. It’s three times bigger than tech giant IBM Corp. and four times larger than Goldman Sachs Group Inc.

Note: Ant Group is not merely an online payment system like PayPal or Wepay.

Ant Group has also over US$173B Assets Under Management, Micro-Lending of over US$290B and Insurance division of approx. US$1b in annual premiums and contributions

Quick comparison between Ant Group and PayPal:

Transaction volumes:

Total Revenue and Fees per transactions:

- Although Ant and PayPal’s revenue are very similar at approx. US$17b to $18b

- The amount of transaction volume by Ant is almost 23 times more than PayPal’s

- Ant charges approx. 0.11% per transaction whereas PayPal at over 2.50%…

- This means Ant could easily increase its overall revenue by raising its per transaction fee basis points.

What do we expect in the FUTURE for Alibaba?

- RMB/CNY transactions

- Future of China

( GDP, Technology, Population, RMB digital currency using blockchain technology backed by People’s bank of China)

- “Two payment services—Ant Group Co.’s Alipay and the pay function within Tencent Holdings Ltd. ’s WeChat app—have already transformed urban China into a seemingly cashless society in which the convenience of digital financial technology has largely neutralized worries about digital payments being inherently trackable.”

Referring the JP Morgan’s Guide to the Market, it is forecast that by 2030, China’s GDP will exceed US overall HDP and China would contribute approx. 31% of total world’s GDP growth. This means in 9 years time we may witness China’s economy covering over 1/3 of world’s economy!!!

If you want to learn more about investing in the China market and not sure where to begin, please contact me to discuss further.

Disclaimer: This publication contains the opinions and ideas of its authors. It is not a recommendation to purchase or sell the securities of any of the companies or investments herein discussed.

Neither the authors nor the publisher can guarantee the accuracy of the information contained herein. The authors and publisher specifically disclaim any responsibility for any liability, loss, or risk, professional or otherwise, which is incurred as a consequence, directly or indirectly, of the use and application of any of the contents of this article.

Sources:

https://www.youtube.com/watch?v=KveMLJNhwkc

https://www.barrons.com/articles/charlie-munger-alibaba-stock-51633627243

https://www.fool.com/investing/2021/10/07/charlie-munger-just-doubled-down-on-alibaba/

https://edition.cnn.com/2021/11/10/business/china-singles-day-intl-hnk/index.html

https://seekingalpha.com/article/4321013-alibaba-swot-analysis

https://www.wsj.com/articles/chinas-digital-currency-challenge-winning-hearts-and-minds-11638441000