Putting your money aside in a piggy bank or a bank savings account is a good start on building wealth. There are opportunity costs and inflation that may eat away your savings more than you may realise. For example, in Feb 2023, the inflation rate in UK & US were 10.1% and 6% respectively. This means that, an average savings account was losing 10.1% value of pounds.

This article will share 7 basic principles on how to save money to become a Millionaire:

Principle #1 – Stay Away From Debt

A true story told by Ivanka Trump (eldest daughter of Donald Trump) where she recalled one time when Donald was walking out of his Trump Tower in New York City he pointed at a homeless man sitting outside of the doorstep and said, “that homeless man has $8b more than me…” this story is to illustrate sometimes having too much debt is not a good problem to have, Donald had such extreme debt at that point he feels insecure about his own net worth.

Furthermore, if you are not a risk taker and have very limited knowledge about investment, it is better to stay away from debt.

Principle #2 – Invest Early & Consistently

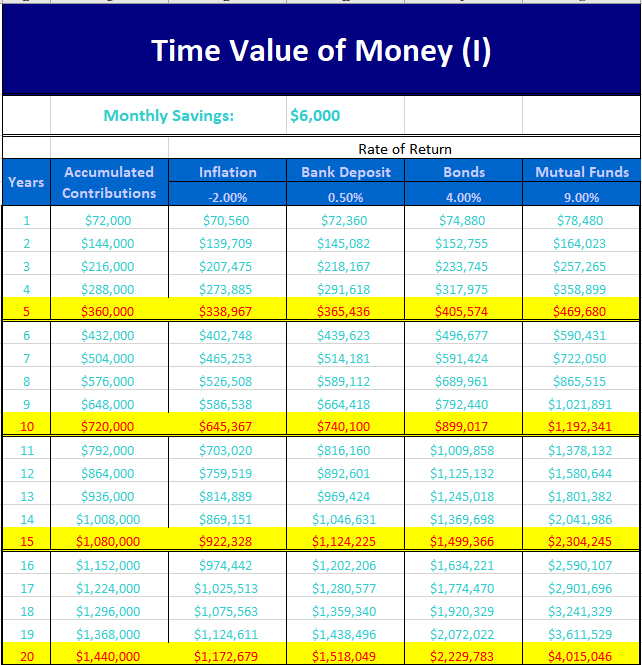

The earlier you start investing, the more likely you are to become a millionaire. The time value of money is an important concept to learn. Compound interest of money will accumulate your wealth faster than you would imagine. For example, start saving $6,000/month or $72,000/year. By the 9th year, you would have saved a total of $720,000 and using a 9% pa compound interest earning per year. You will be a millionaire:

Principle #3 – Make Savings A Priority

Start with baby steps, saving 10% of your monthly income, then slowly build up to saving 20%, 25%, 30% or even 50% of your monthly income. By building this habit and making savings your priority, you will see dramatically the effects on your overall total savings balance.

Why? Because if you want to become a millionaire, how much money you invest is just as important as the actual act of investing. It takes baby steps Millionaires, for example investing 15% of your income toward retirement, about 20 years or less to reach millionaire status from the beginning of your journey!

From study shows, 70% of millionaires saved more than 10% of their income throughout their working years. The good news is, majority of Asians are good savers. In particular Singaporeans and Chinese who has the highest National Savings rate (% of GDP)

Principle #4 – Increase Your Income To Reach Your Goal Faster

You don’t need a huge salary to become a millionaire, but you increase your income streams. For example, investing in dividend and interest paying vehicles, starting a side business such as teaching, online courses, go back to school or get training to increase your skills and earning potential.

If you want to reach millionaire status a little bit faster, then the best way to do that is to boost your income. The more money you make, the more you can invest!

Based on studies of all millionaires (97%) believe they control their own destiny. This means they don’t just sit around and wait for things to magically change—they go out and do something about it.

Principle #5 – Cut Unnecessary Expenses

Cutting expenses is easier said than done. Most people find it easier to spend than saving the money for themselves, because nowadays it is too convenient and easy to buy things online.

The goal is to live on less than you make and stick to the budgets you create each month. Having a budget on spending is a good way to keep track of all your expenses. There are fixed costs and variable costs that you should illustrate in your budget.

If you would like to start budgeting your expenses, you may start by completing the QUESTIONNAIRE and we can send out an expense excel spreadsheet to you to use for free.

Principle #6 – Keep Your Millionaire Goal Front and Center

Millionaires do not act how others are doing e.g. friends and family going places, doing stuff or buying new things. If you are easily influenced by others on spending money, it will be hard for you to own your own money.

Almost 50% of the millennials are influenced by social media and how they spend their money. This is becoming a big problem, because they are not in control of their own money and getting stuck into this comparison culture.

Principle #7 – Work with Financial Professional

Finally, if you are very ill and need to find a doctor. You don’t just stay at home and hope the sickness will recover on its own. This is same as finding a financial professional who has studied and experience in helping financial sick patients that needs some guidance and medication for them to improve about their future financial situation and achieve a goal.

You can think of a good personal trainer on your side where you are constantly reminded to exercise regularly and correctly so that you are getting closer to your fitness goals (e.g. lose weights or gain muscles or achieve a milestone)

A financial advisor can be your on personal trainer to work along side you to achieve your financial goals such as to become a millionaire !

If you like to learn more, please contact me admin@ryanmow.com or +852 6227 9931

#millionaire #savingshabit #lifegoals #donaldtrump #investment #investing #professionalinvestor #financialplanning